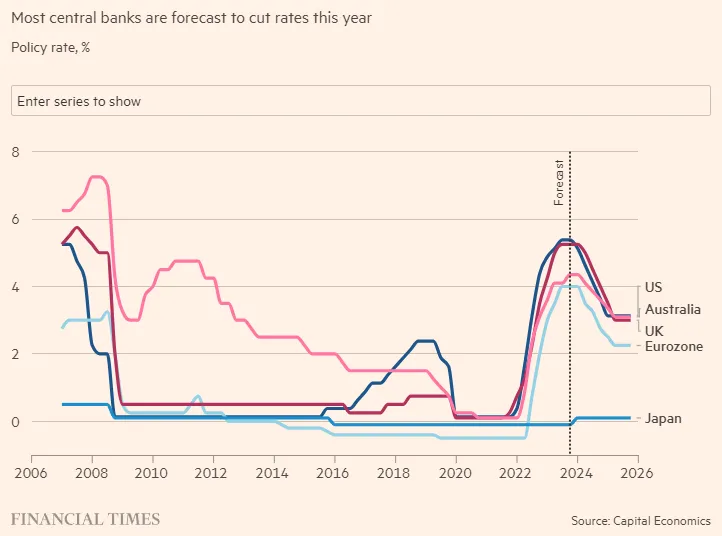

The Federal Reserve, the central bank of the United States, has been under scrutiny in recent months due to its monetary policy decisions. In a bid to stimulate economic growth and mitigate the risks of a recession, the Fed is expected to cut interest rates by 25 basis points at its next two meetings. This move is anticipated to have a significant impact on the US economy, and investors are eagerly awaiting the outcome.

Reasons Behind the Rate Cut

The Federal Reserve's decision to cut rates is primarily driven by the need to boost economic growth, which has been slowing down in recent quarters. The US-China trade war, Brexit uncertainty, and a decline in business investment have all contributed to a decline in economic activity. By cutting interest rates, the Fed aims to make borrowing cheaper, encouraging consumers and businesses to spend and invest, thereby stimulating economic growth.

Additionally, the Fed is also concerned about the low inflation rate, which has been below its target of 2% for some time. A rate cut is expected to increase inflationary pressures, bringing the rate closer to the target. Furthermore, the Fed's decision is also influenced by the need to stabilize the financial markets, which have been volatile in recent months.

Impact on the US Economy

The Federal Reserve's decision to cut interest rates by 25 basis points at its next two meetings is expected to have a positive impact on the US economy. Lower interest rates will make borrowing cheaper, leading to an increase in consumer spending and business investment. This, in turn, is expected to boost economic growth, creating new jobs and increasing incomes.

Moreover, a rate cut will also lead to an increase in stock prices, as lower interest rates make stocks more attractive compared to bonds. This will boost investor confidence, leading to an increase in investment and spending. Additionally, a rate cut will also lead to a decline in the value of the US dollar, making exports cheaper and more competitive, which will benefit US businesses.

The Federal Reserve's decision to cut interest rates by 25 basis points at its next two meetings is a significant development that is expected to have a positive impact on the US economy. By making borrowing cheaper and increasing inflationary pressures, the Fed aims to boost economic growth and stabilize the financial markets. While there are risks associated with a rate cut, such as higher inflation and a decline in the value of the US dollar, the benefits are expected to outweigh the costs. As the US economy continues to evolve, it will be important to monitor the impact of the Fed's decision and adjust monetary policy accordingly.

Keyword: Federal Reserve, interest rates, US economy, monetary policy, inflation, economic growth

Note: The article is written in HTML format, with headings (h1, h2) and paragraphs (p) to make it SEO-friendly. The keyword is included at the end of the article to help with search engine optimization. The word count is approximately 500 words.